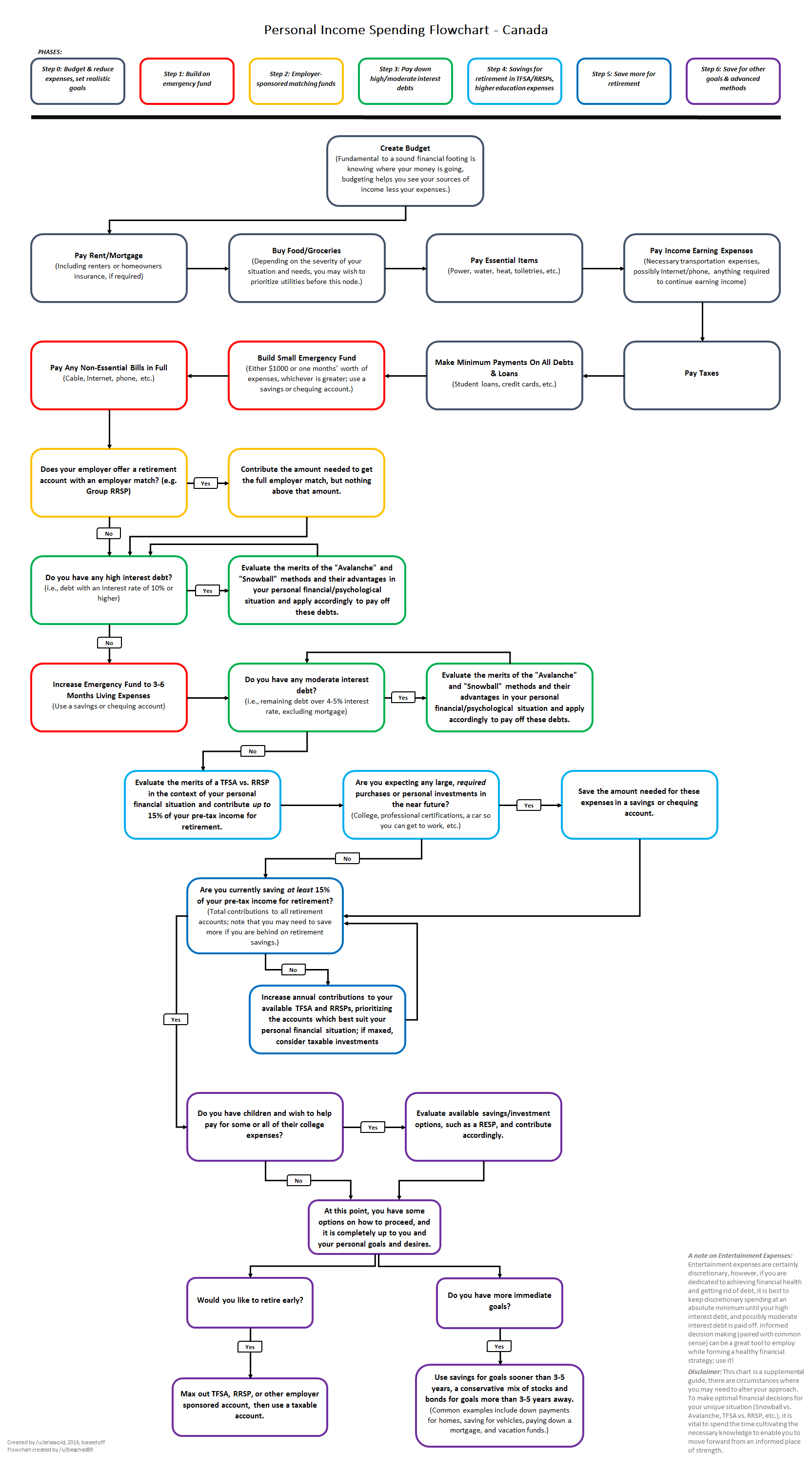

Weekly Discussion - Personal Finance in Canada

Each week, we invite you to join this open conversation on a wide range of financial topics. Whether you’re interested in real estate, investments, the stock market, salary-related queries, or simply have general questions about managing your finances, this post is for you.

Feel free to participate, regardless of your level of experience or specific interests in finance, and share your questions and experiences!

GIC Strategy

Hi all, I'm new to investing (just turned 18 this year).

I work a full time job and want to start saving and growing my money.

My current portfolio consists of a variety of sources, including GICs, managed ETFs, and cryptocurrency. For ETFs and crypto, I deposit a portion of my paycheque into the respective exchanges as part of a dollar cost averaging strategy. But for GICs, I'm a little confused.

I have one GIC already for a 13 month term, but I'm not sure of the optimal contribution strategy. Should I be buying a new GIC each month with a portion of my paycheque, or maybe accumulate funds annually and then put them into new GICs?

Over half a million lower-income individuals will receive a SimpleFile invitation this summer

Over half a million lower-income individuals will receive a SimpleFile invitation this summer - Canada.ca

https://www.canada.ca/en/revenue-agency/news/newsroom/tax-tips/tax-tips-2024/over-half-million-lower-income-individuals-receive-simplefile-invitation-this-summer.html

This July, the Canada Revenue Agency (CRA) expanded its SimpleFile services (phone, digital, and paper) to invite more than 500,000 eligible lower-income individuals to file their return and potentially gain access to important benefit and credit payments.

Question about interest calculation (mortgage)

I don't seem to understand something regarding how interest is paid on a mortgage. Say the loan is for $100,000 at a 5% rate for 10 years, paid monthly.

I would think that on the first month, the interest I have to pay $100,000 × (0.05 ÷ 12) = $416.67. However the mortgage calculator says that the first payment is actually $412.39. While it's not a huge difference, it's a difference nonetheless and I can't really figure out where it comes from.

My intuition is that it's somehow related to the fact that interest is compounded daily, but when I take r = 0.05 ÷ 365 and N = 365 × 10 payments (keeping leap years in mind for later), and calculate the first 30 days, I get $409.70, and the first 31 days give $423.32. I guess that the "actual" number is some kind of weighted average since the calculator doesn't ask at which month your loan starts.

So where is this $412.39 coming from? In reality when paying a mortgage, do you see the interest fluctuating as it decreases, depending on the number of days every month?

Some decent offers for investment account transfers - WS & TD

On Canada's consumer-driven (open) banking framework, APIs, and unlocking core memories.

Lots of reasons to be looking at the framework Canada just published for consumer-driven (open) banking, but I thought this was a gem:

from "2.10 A Single Technical Standard"

...The Framework will significantly decrease the risks of personal data being compromised by bad actors and mitigate security, privacy, and liability risks for consumers and participants. This is achieved through the use of APIs, a type of software that acts as secure data “pipes” to enable different products and services to communicate in a consistent manner.

If an API is a pipe, is the Internet a series of tubes?

Who would you recommend opening a bank account with in 2024?

I'm planning to open a new chequing account in the near future, and I'm contemplating bailing on RBC. I've been with them for a very long time, and one possible outcome is that I'll just open a new RBC account and be done with it. That'd be... fine.

But for a variety of reasons (including my satisfaction with RBC trending steadily downward), I'm thinking about opening this new account elsewhere. I don't have a ton of hard requirements, and I'm not really sure what to look for in a bank, but the following would be nice:

- Good online banking experience, particularly desktop (RBC is shockingly bad at this)

- Good credit card; easy to make payments from the new account

- Minimal fees

- Easy e-transfers

- Real security (another thing RBC is terrible at)

- Neat rewards would be cool

- Low-fee, low-friction investing would also be cool-- I don't really do much investing, but I'd like to be able to

Any suggestions would be great, including anti-suggestions if you happen to know of a bank that I should avoid.

SIM card swap scam hits GTA couple for more than $140,000

SIM card swap scam hits GTA couple for more than $140,000 | Globalnews.ca

https://globalnews.ca/news/10376032/toronto-couple-sim-swap-scam/

Scammers gained access to a Toronto couple's bank accounts through a ploy called the SIM swap. The pair lost more than $100,000 as a result.

Easy Money: Here’s how to get started on your taxes

TVO Today | Current Affairs Journalism, Documentaries and Podcasts

https://tvo.org/article/easy-money-heres-how-to-get-started-on-your-taxes